EMIS Insights M&A report

Emerging Asia M&A Report 2024

About this Report:

Emerging Asia sees 3,224 M&A deals totaling USD 215.7bn in 2024

The M&A market in Emerging Asia saw a rise in activity in 2024, with deal volume increasing by 14.6% y/y to 3,224 transactions. However, a slowdown in large-scale deals and lower valuations led to a 29.3% y/y decline in total transaction value, which fell to USD 215.7bn.

India saw a strong resurgence in M&A activity, rebounding sharply from the slowdown in dealmaking between mid-2022 and 2023. The number of transactions soared by 39.5% y/y to 1,145, with all major sectors experiencing growth. The most significant increase was in the Machinery, Electronics & Appliances sector, where deal volume more than doubled, driven by government initiatives aimed at positioning India as the region’s leading manufacturing hub. Total deal value jumped by 61.9% y/y to USD 56.2bn, largely fueled by the landmark USD 8.5bn merger between Reliance Industries and Walt Disney, alongside major transactions in the Telecom and Food sectors. Looking ahead, dealmaking in 2025 is expected to remain robust, supported by sustained entrepreneurial activity, strong domestic consumption, and a thriving startup ecosystem.

M&A activity in the ASEAN region grew by 6.8% y/y in terms of deal volume, but total transaction value dropped sharply by 32.8% to USD 47.5bn. Malaysia led the expansion, driven by strong dealmaking in the Real Estate & Construction and Wholesale & Retail sectors. Thailand also contributed to the increase, with a broad-based rise in transactions. Vietnam’s M&A market also gained momentum, supported by the country’s dynamic economic environment.

This sample report provides comprehensive M&A insights, with access to:

- Emerging Asia Overview: India and ASEAN M&A Outlook

- Internet & IT, and Machinery & Electronics Dominance

- Deals by Sector and Volume

- Foreign Investor Influence

Learn more and join us on March 12 for an insightful panel discussion as we delve into the dynamic M&A landscape of India and ASEAN nations, with a comprehensive analysis of key trends, emerging opportunities, and the factors driving growth in the region from this report. Register now

Are you interested in the full version of the report, which includes detailed M&A insights, more data, and analysis from the world's fastest-growing markets?

ABOUT EMIS INSIGHTS

What sets EMIS reports apart and makes them trustworthy?

EMIS offers a large repository of content to support journalists in reporting on emerging markets from both a country-specific and industry-specific perspective. Our team of researchers and economists analyses the industries and M&A landscape of key emerging markets, providing accurate and detailed intelligence to equip journalists with the necessary knowledge to cover these markets with confidence.

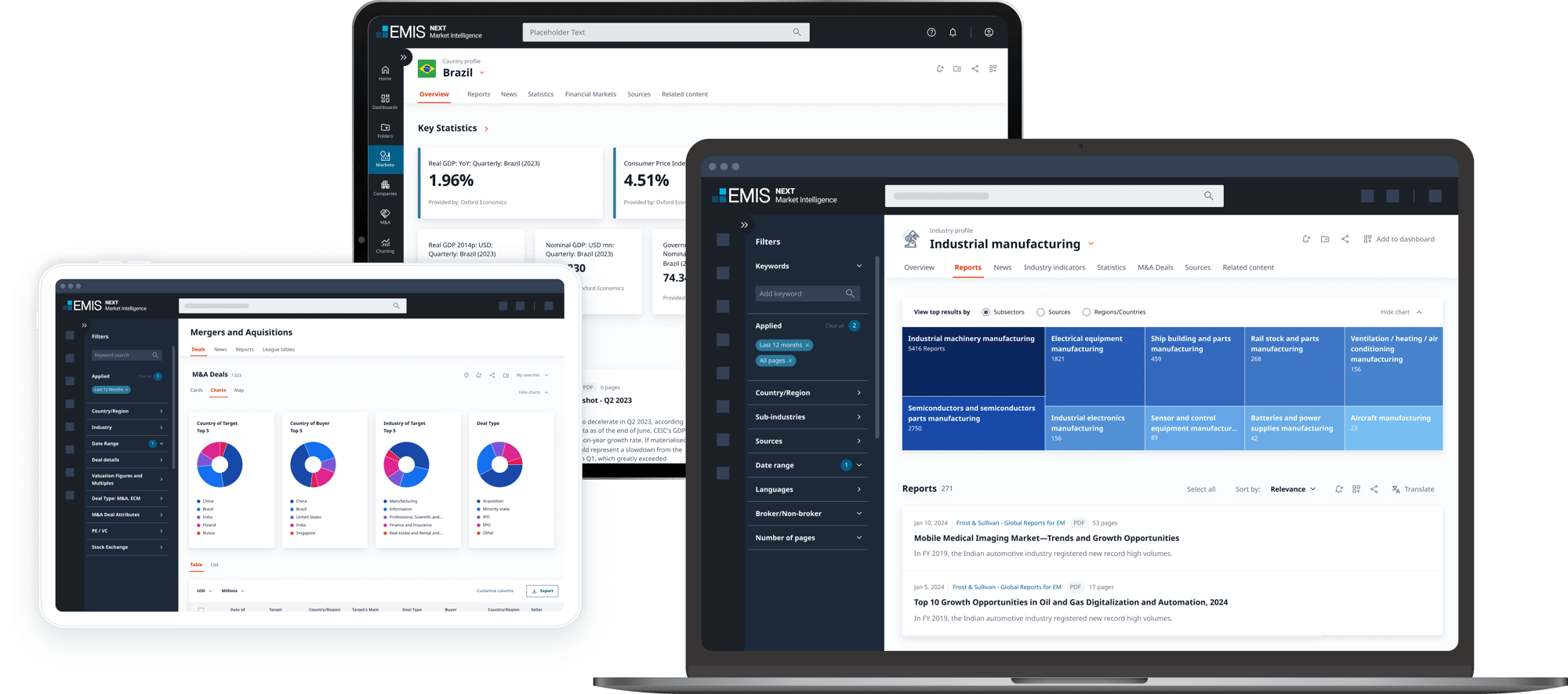

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest-growing markets. We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools. EMIS delivers trustworthy intelligence covering more than 370 industry sectors and 12 million companies across 197 markets – providing everything you need in one place as actionable insights are facilitated by leading technology. EMIS is part of ISI Markets.

EMIS Insights

EMIS’ industry research division, EMIS Insights, provides in-depth, industry research in key emerging markets worldwide, featuring market overviews, industry trend analysis, legislation and profiles of the leading sector companies provided by experienced locally-based industry analysts.

EMIS Insights M&A Reports

EMIS Insights M&A reports provide analytical summary of M&A activity in key emerging regions and countries. Contents include an overview of M&A activity by deal volume and value, activity by sectors, foreign investors, private equity, valuation trends, top M&A deals and IPOs, advisory league tables, and analysis of the latest developments and future expectations.