EMIS Insights industry report

ASEAN Infrastructure Sector Report 2024-25

About this Report:

The countries of the Association of Southeast Asian Nations (ASEAN) are vastly diverse and uneven landscapes in terms of infrastructure development. For instance, Singapore is a perennial global leader in infrastructure quality whereas other countries in the region have serious infrastructure deficiencies that hamstring the efficiency and competitiveness of their economies. What the countries of the ASEAN have in common, however, is the understanding that infrastructure underpins growth, and the vision to invest in the sector’s development. This was reflected in the resilience of infrastructure investment across the region in 2023 despite economic and geopolitical uncertainty, high inflation, and lacklustre global demand for goods and services.

In recent years, members of the ASEAN Economic Community (AEC) have implemented sectoral reforms to attract foreign investments, especially for physical connectivity and renewable energy infrastructures. Governments in the region have codified frameworks such as Public-PrivatePartnerships and Build-Operate-Transfer into laws to facilitate projects in the infrastructure sector. Following the examples of Singapore and Thailand, Indonesia and the Philippines have relaxed limitations on foreign ownership in specific sectors and under particular circumstances. In line with the recent trend for regional integration, Singapore and Thailand entered agreements with Cambodia, Laos, and Malaysia to purchase energy, especially from renewable sources. Apart from the goal of shifting the energy mix to comprise more renewable sources, expanding and upgrading the connective infrastructure is a significant focus for countries like the Philippines, Thailand, and Vietnam.

This sample report provides a comprehensive sector overview, with access to:

- Demographic profile of ASEAN countries

- Sector snapshot and outlook

- Driving and restraining forces

- Main economic and sector indicators

Are you interested in the full version of the report, which includes detailed insights into the infrastructure sector, more data, and analysis from the world's fastest-growing markets?

ABOUT EMIS INSIGHTS

What sets EMIS reports apart and makes them trustworthy?

EMIS offers a large repository of content to support journalists in reporting on emerging markets from both a country-specific and industry-specific perspective. Our team of researchers and economists analyses the industries and M&A landscape of key emerging markets, providing accurate and detailed intelligence to equip journalists with the necessary knowledge to cover these markets with confidence.

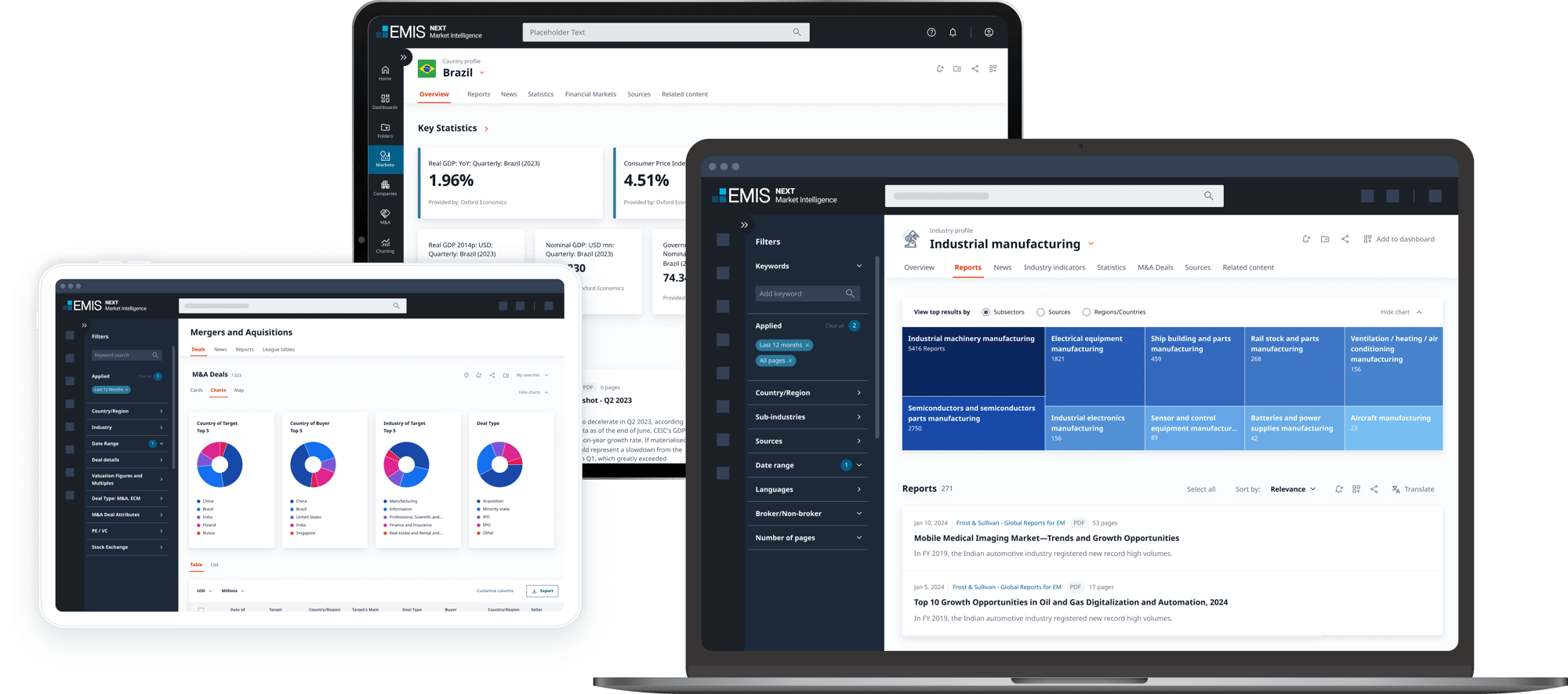

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest-growing markets. We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools. EMIS delivers trustworthy intelligence covering more than 370 industry sectors and 12 million companies across 197 markets – providing everything you need in one place as actionable insights are facilitated by leading technology. EMIS is part of ISI Markets.

EMIS Insights

EMIS’ industry research division, EMIS Insights, provides in-depth, industry research in key emerging markets worldwide, featuring market overviews, industry trend analysis, legislation and profiles of the leading sector companies provided by experienced locally-based industry analysts.

EMIS Insights M&A Reports

EMIS Insights M&A reports provide analytical summary of M&A activity in key emerging regions and countries. Contents include an overview of M&A activity by deal volume and value, activity by sectors, foreign investors, private equity, valuation trends, top M&A deals and IPOs, advisory league tables, and analysis of the latest developments and future expectations.