About the Report

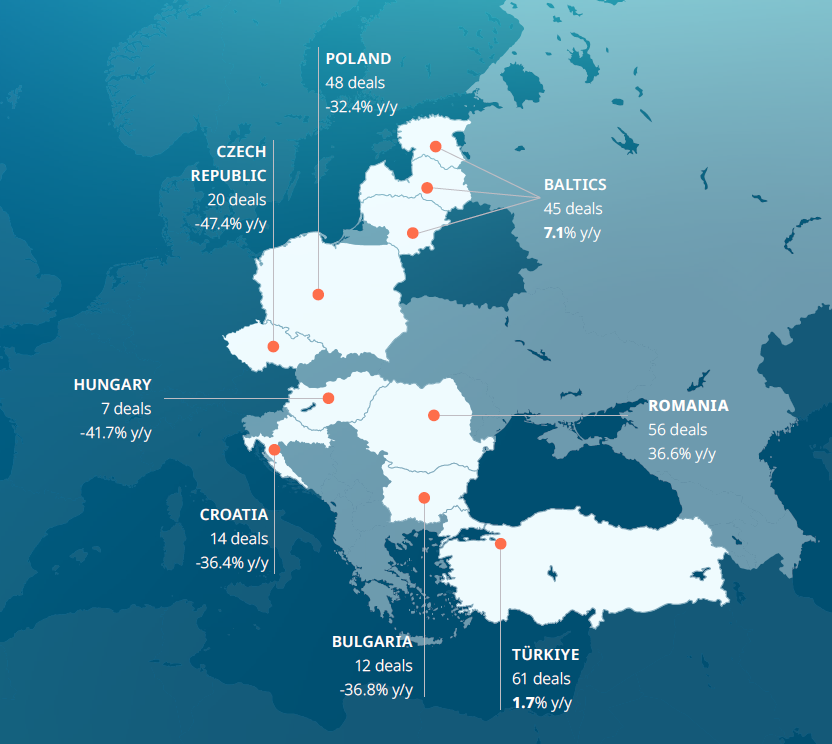

In Q1 2025, M&A activity in Central and Eastern Europe fell by 12.4% y/y, with 324 transactions recorded. Rising economic uncertainty and concerns over international trade made investors more cautious, particularly in key markets like Poland and the Czech Republic, leading to a slowdown in deal flow. However, despite the dip in volume, total transaction value surged by 24% y/y to EUR 8.5bn, driven by a handful of high-value deals. Notably, Denmark’s Salling Group acquired the Baltic retail operations of Swedish peer ICA Gruppen for EUR 1.3bn, while largescale energy transactions in Turkey and telecom deals in Serbia also contributed significantly to the value uptick.

In Q1 2025, Poland’s M&A activity fell 32.4% y/y to just 48 deals - a level not seen since the pandemic—reflecting a cautious investment climate.

In Q1 2025, the Czech Republic’s M&A market continued its downward trajectory, with deal volume plunging 47.4% y/y to 20 transactions and total deal value dropping to EUR 205mn.

In Q1 2025, Romania stood out as a rare bright spot in Eastern Europe’s M&A landscape, with deal volume rising 36.6% y/y to 56 transactions.

In Q1 2025, Türkiye’s M&A market held steady, with deal volume up 1.7% y/y to 61 deals and total value soaring to nearly EUR 3.0bn supported by macroeconomic resilience and energy transition.

M&A activity in the Baltic countries remained strong in Q1 2025, with deal volume rising 7.1% year-on-year to 45 transactions across Estonia, Latvia, and Lithuania.

CEE deal volume slows, but big-ticket transactions lift total value.

CEE M&A Report Content

- Overview for Central and Eastern Europe (Poland, Hungary, the Czech Republic, Romania, Turkey and Baltics)

- Valuation

- Deals by Sector

- Deals by Foreign Investor

- Top M&A Deals

- Private Equity Deals

- Top IPOs

- League Tables

![]()

Are you interested in the full version of the report & more insights into the M&A landscape,

more data, and analysis from the world's fastest-growing markets?

Ready to explore EMIS?

What sets EMIS apart?

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest growing markets.

We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools.

EMIS delivers trustworthy intelligence for over 370 industry sectors and over 12m companies (including +190k M&A and ECM deals) across 197 markets. Everything you need in one place where actionable insights are facilitated by leading technology.

.png)