About the Report

CEE Agribusiness Sector Report 2026-2027 Overview

▪️ Sector Overview and Outlook

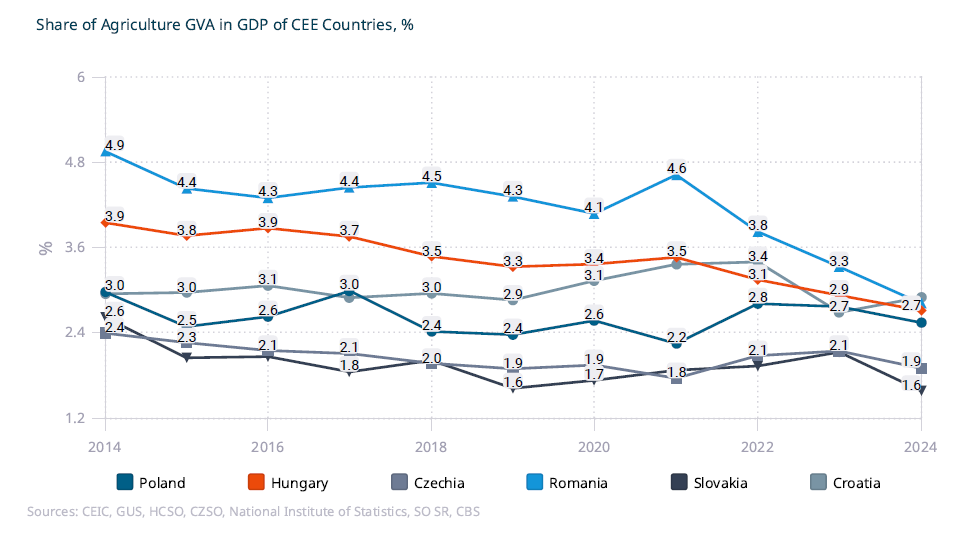

The agribusiness sector in Poland, Czechia, Hungary, Romania, Slovakia and Croatia is characterised by structural resilience and gradual recalibration rather than expansion. Although the economic weight of agriculture continues to decline across most countries, the region retains a strong production base and trade relevance within the EU, supported by cereals, livestock, and selected higher-value segments.

The short to medium term outlook is shaped by moderating macroeconomic growth, stabilising prices, and continued reliance on EU support. Competitiveness would increasingly be determined by scale, technology adoption, and integration into processing and export chains.

▪️ Drivers and Constraints

The analysis sets out a balanced view of the forces shaping agribusiness performance across CEE. On the supportive side, EU Common Agricultural Policy funding, access to the single market, and ongoing modernisation through digitalisation and precision farming underpin output and incomes. Drivers are counterbalanced by persistent constraints climate volatility, rising regulatory and compliance costs, labour shortages, fragmented farm structures in parts of the region, and exposure to global commodity price swings. The interaction of these drivers and constraints explains diverging national trajectories within a broadly shared regional framework. The section answers the question of why CEE agribusiness remains competitive at the regional level, yet its development is uneven and increasingly polarised between modernised leaders and small-scale structurally challenged producers.

▪️ Detailed Coverage of Crops and Meat Production

The report delivers an in-depth assessment of crop and livestock production, positioning cereals as the structural backbone of CEE agriculture, and highlighting pulses, vegetables, and selected fruit segments as areas of uneven momentum. It shows how weather variability and input costs translate directly into production volatility, particularly in fruit and horticulture. In livestock, poultry emerges as the most resilient and competitive segment, supported by feed integration and export demand, while pork and beef face disease risks, environmental pressures, and consolidation. This part offers readers a comprehensive outline of how production structures differ across crops and meats, and why livestock and especially poultry, plays a stabilising role in CEE’s agribusiness model.

▪️ Farm Structure and Competitive Landscape

This section reveals a dual farm structure across most CEE countries, consisting of many small family farms with limited market power alongside a smaller group of large, capital-intensive and often vertically integrated players. The report profiles leading agribusiness groups active in crops, feed, meat processing or dairy, showing how scale, access to finance, and control over logistics and processing increasingly determine competitiveness.

▪️ Trade Flows and Market Integration

The report provides a regional view of agrifood trade, highlighting structurally different positions across CEE countries. While some markets sustain sizeable surpluses driven by cereals, poultry, dairy, and beef, others remain structurally import-dependent in fruit, vegetables, meat, and dairy products. Intra-EU trade dominates, reinforcing the importance of regulatory alignment and logistics connectivity. Exposure to external shocks has increased through Ukrainian grain inflows and global market volatility.

▪️ CAP Strategic Plans and Policy Framework

The extensive policy section unpacks the role of the EU Common Agricultural Policy and country-specific CAP Strategic Plans for 2023–2027. The report details how national priorities differ in targeting income support, environmental measures, rural development, and innovation, while remaining tied to shared EU objectives. It also examines how eco-schemes, animal-welfare rules, and climate requirements are reshaping cost structures and investment decisions at farm level.

▪️ EU Trade Agreements and External Policy Developments

The analysis extends beyond internal EU policy to assess the implications of key external trade dynamics, notably the evolving EU–Ukraine trade framework and the prospective EU–Mercosur agreement. It explains how Ukrainian imports have intensified competitive pressure in cereals and oilseeds, while Mercosur raises longer-term questions around meat, sugar, and environmental standards. These developments are presented as structurally important variables for price formation, farm incomes, and political risk across the region.

![]()

Are you interested in the full version of the report & more insights into the Agribusiness Sector,

more data, and analysis from the world's fastest-growing markets?

Ready to explore EMIS?

What sets EMIS apart?

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest growing markets.

We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools.

EMIS delivers trustworthy intelligence for over 370 industry sectors and over 17m companies (including +190k M&A and ECM deals) across 197 markets. Everything you need in one place where actionable insights are facilitated by leading technology.

EMIS Insights

EMIS’ industry research division, EMIS Insights, provides in-depth, industry research in key emerging markets worldwide, featuring market overviews, industry trend analysis, legislation and profiles of the leading sector companies provided by experienced locally-based industry analysts.

EMIS Insights M&A Reports

EMIS Insights M&A reports provide analytical summary of M&A activity in key emerging regions and countries. Contents include an overview of M&A activity by deal volume and value, activity by sectors, foreign investors, private equity, valuation trends, top M&A deals and IPOs, advisory league tables, and analysis of the latest developments and future expectations.

.png)