Emerging Europe M&A Report 2024/25

EMIS, along with leading global law firm CMS, are pleased to bring to you the 14th edition of the annual Emerging Europe M&A Report for 2024/25. Register now for your free copy.

.webp)

Results of the Report at a Glance

- Deal activity maintains a steady pace

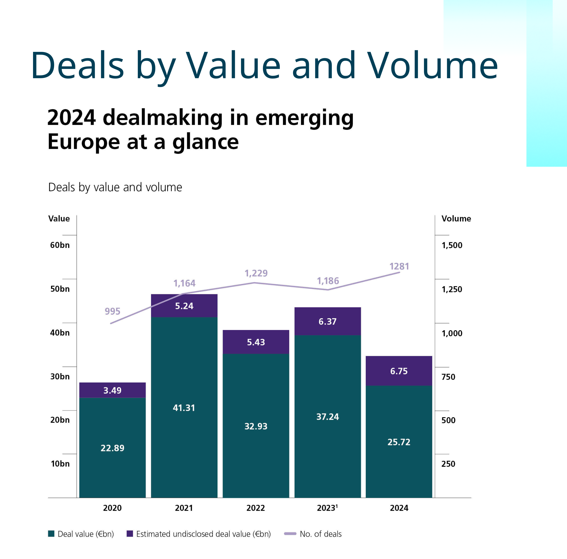

Transaction volumes ended the year on a positive note, up by 8% at 1,281 deals compared with 1,186 in 2023 - a five-year high overall. Values, however, fell by 30.9 % year-on year to EUR 25.72 bn, driven by a relative absence of mega deals as small and medium-sized deals predominated. - Largest sectors

By recorded deal value, the largest sectors were Energy & Utilities, Real Estate & Construction and Food & Beverage. The largest transactions involved Czech company Energeticky a Prumyslovy Holding, which took control over Slovenske elektrarne in Slovakia after acquiring an additional 33% in a deal valued at EUR 3.99 bn.

-

Private equity involved in 21.7 % of deals

PE investors were involved in 278 deals, up by 12.6 % on 2023, with an aggregate deal value of EUR 13.88 bn, down by 11.4 % year-on-year. CVC Capital Partners, which acquired Partner in Pet Food (PPF) in Hungary for EUR 2.0bn and stood out as the biggest transaction by value. - Stable cross-border deal activity

Cross-border deal activity remained strong in 2024, with an increase from 745 to 776 deals last year, although values decreased from EUR 35.5 bn to EUR 23.3 bn. Domestic deal volumes rose from 441 to 505, while values picked up by 39.7% to EUR 2.4bn. Among emerging European countries, the largest investor countries were Czechia (EUR 8.9 bn), Poland (EUR 1.3bn), and Estonia (EUR 590m). The fourth country in investments by value was Romania (EUR 577m).

Sector Trends

Energy & Utilities rebounded strongly accounting for 37.9 % of total deal value at combined EUR 9.74 bn.

Real Estate & Construction also stage a notable recovery with deal value increasing by 77.2 % to reach EUR 5.65 bn, with 194 transactions.

Food & Beverage increased by 157.2.%, reaching EUR 2.46 bn in 64 transactions.

Country M&A Deal Volumes

The most active M&A markets in the region by deal volume:

Poland - 269

Romania - 187

Ukraine – 135

Czech Republic – 128

M&A Activity Time Trend

Overcoming significant uncertainty, levels of M&A activity in 2024 demonstrate the continued resilience of CEE markets. Transaction volumes ended the year up by 8% at a five-year high of 1,281 deals compared with 1,186 in 2023.

Values, however, fell by 30.9 % year-on year to EUR 25.72 bn as there were fewer big deals compared with 2023, when seven of the top ten transactions were valued at more than EUR 1bn. Instead, there was a shift towards small and mid-market deals as the average deal value fell to €20.1 million in 2024 against €31.4 million in 2023.

Background stories and analysis covered

in the Emerging Europe M&A Report 2024/25

Transactions Trends in M&A

Against a background of continued geopolitical uncertainty and the return of price stability, how has dealmaking evolved in CEE? Which sectors are attracting most attention, and why?

The Rise of Strategic Buyers over Private Equity in CEE Markets

In a quieter private equity market, the number of strategic buyers in CEE is increasing. Seeking to add synergistic value to their portfolio, what areas are generating most interest?

The Impact of AI on M&A Strategies

As AI continues to affect every aspect of commercial life, it is reshaping M&A strategies across the CEE region: influencing the dealmaking process, presenting acquisition opportunities, and creating areas of potential value. When considering AI value, what are companies looking for in an acquisition and how is AI impacting upon the deal landscape?

The Rise of Family Office Investments in CEE

Family Offices are increasingly attracted to CEE, both as strategic investors looking for a proven track record of success in established businesses and offering capital and strategic guidance in startups. So, what is fuelling their interest in the CEE region?

Manufacturing and Industrial M&A: Consolidation and Expansion

Industrial production in CEE is projected to grow by more than the eurozone in the next five years. As the region’s strong manufacturing base continues to navigate towards a high-tech future, how is it consolidating and where is it expanding?

Healthcare and Pharmaceuticals: A New Hotbed for Investment

Healthcare and pharmaceuticals form a bedrock of growth in CEE with the region’s governments looking to deliver better healthcare outcomes and quality of care. As innovative treatments, diagnostics and digital infrastructure progress at speed, what investment opportunities do they present?

TMT Deals in CEE: Special Focus on Tech Companies

CEE countries enjoy a reputation for being early adopters of new innovative technologies, particularly in broadband and mobile telecommunications. We examine how deals are being driven by the region’s telecom companies and the outlook for CEE tech companies.

What sets EMIS apart?

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest growing markets. We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools. EMIS delivers trustworthy intelligence for over 370 industry sectors and over 12m companies across 197 markets. Everything you need in one place where actionable insights are facilitated by leading technology.

What Our Customer Say

EMIS Insights

EMIS’ industry research division, EMIS Insights, provides in-depth, industry research in key emerging markets worldwide, featuring market overviews, industry trend analysis, legislation and profiles of the leading sector companies provided by experienced locally-based industry analysts.

EMIS Insights M&A Reports

EMIS Insights M&A reports provide analytical summary of M&A activity in key emerging regions and countries. Contents include an overview of M&A activity by deal volume and value, activity by sectors, foreign investors, private equity, valuation trends, top M&A deals and IPOs, advisory league tables, and analysis of the latest developments and future expectations.