EMIS Insights INDUSTRY report

CEE Transportation Sector Report

2025-2026

.png)

About this Report:

The Central Europe region, as covered by the scope of this report, consists of Poland, Romania, the Czech Republic, Hungary, Slovakia and Croatia. All of these countries are strategically important to transportation in the region, to a varying extent, depending on their geographic location and size.

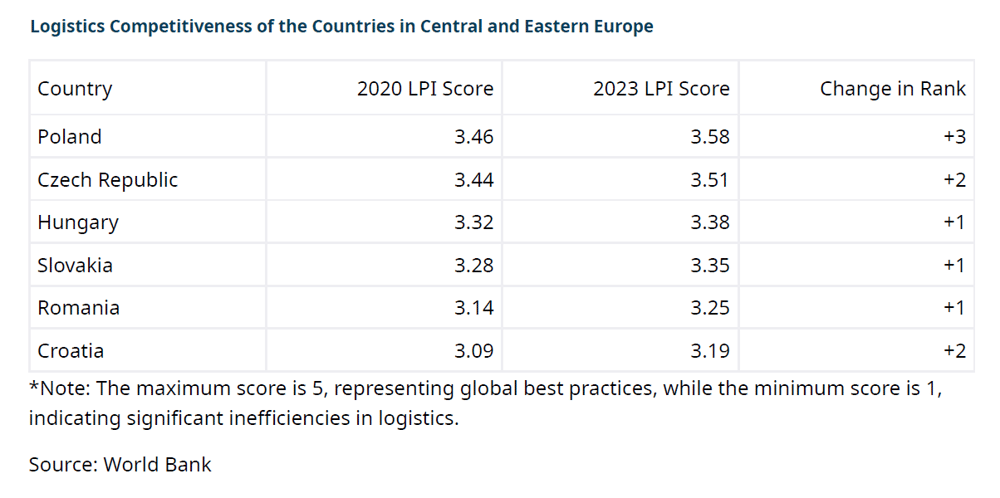

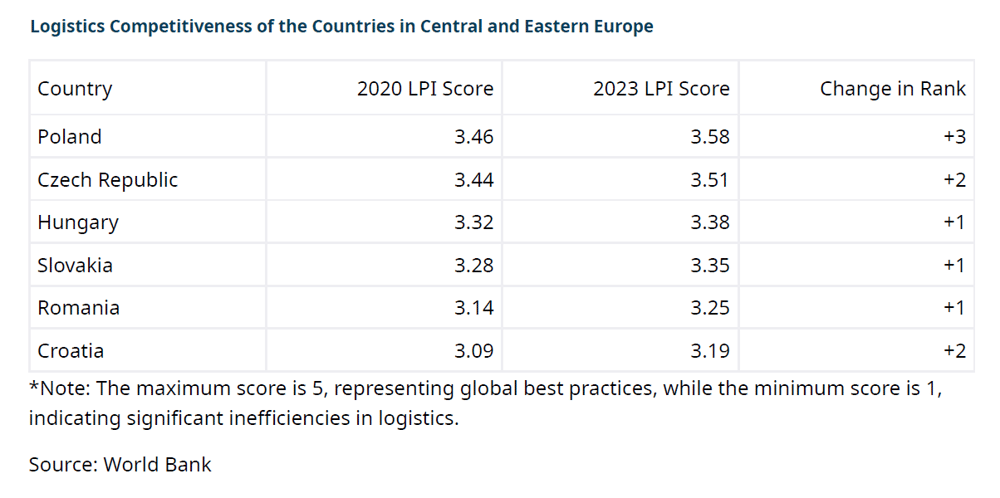

Logistics Competitiveness

Logistics competitiveness plays a crucial role in shaping the economic and trade prospects of nations. The World Bank's Logistics Performance Index (LPI) serves as a key benchmark for assessing the efficiency of supply chain systems worldwide. The 2023 edition of the LPI, covering 139 countries, evaluates logistics performance based on six dimensions: customs efficiency, infrastructure quality, international shipments, logistics competence, tracking and tracing, and timeliness.

Scoring System: The LPI score ranges from 1 to 5, with higher scores indicating better logistics performance. The global average for 2023 was approximately 3.0.

CEE Performance: Countries in the CEE region demonstrate mixed results, with Poland, Czech Republic, and Hungary consistently ranking higher than Romania and Croatia. However, none of the CEE countries outperform global leaders like Germany, which topped the 2023 index with a score of 4.31, reflecting advanced infrastructure, seamless customs processes, and efficient logistics systems.

Regional Analysis

1. Top Performers:

Poland: As a regional leader, Poland's LPI score reflects its robust road and rail networks and strong integration with European supply chains. Investments in infrastructure under EU funding mechanisms, like the Connecting Europe Facility (CEF), have further enhanced its competitiveness.

Czech Republic and Hungary: These countries also perform well due to modernised transport networks and strong links to Western European markets.

2. Room for Improvement:

Romania: Despite improvements, Romania still struggles with infrastructure bottlenecks and in efficiencies in customs processes. However, ongoing investments in the Danube river corridor and road infrastructure are expected to enhance its logistics performance.

Croatia: While progress has been made, Croatia’s logistics sector remains constrained by its fragmented geography, which complicates the efficiency of land transport systems.EU-backed port upgrades and road projects aim to address these challenges.

3. Challenges and Opportunities:

Challenges: The CEE region faces shared challenges, including labour shortages in the transport sector, geopolitical tensions from the Russia-Ukraine war, and rising fuel costs.

Opportunities: Continued investments in digitalisation, multimodal transport systems,and green logistics off er opportunities for sustained improvements.

Comparison with Global Leaders

CEE countries lag behind Western Europe in LPI rankings, with the highest-ranked regional performer (Poland) still trailing Germany and the Netherlands. However, the region is rapidly catching up, leveraging EU funding and increasing integration with global supply chains.Investments in smart logistics and sustainable infrastructure could further boost the region’s standing.

The LPI underscores the need for targeted reforms in infrastructure, regulatory frameworks, andcross-border coordination to enhance logistics competitiveness in CEE. With ongoing improvements the region is well-positioned to strengthen its role as a vital logistics hub in Europe.

Logistics Competitiveness

Logistics competitiveness plays a crucial role in shaping the economic and trade prospects of nations. The World Bank's Logistics Performance Index (LPI) serves as a key benchmark for assessing the efficiency of supply chain systems worldwide. The 2023 edition of the LPI, covering 139 countries, evaluates logistics performance based on six dimensions: customs efficiency, infrastructure quality, international shipments, logistics competence, tracking and tracing, and timeliness.

Scoring System: The LPI score ranges from 1 to 5, with higher scores indicating better logistics performance. The global average for 2023 was approximately 3.0.

CEE Performance: Countries in the CEE region demonstrate mixed results, with Poland, Czech Republic, and Hungary consistently ranking higher than Romania and Croatia. However, none of the CEE countries outperform global leaders like Germany, which topped the 2023 index with a score of 4.31, reflecting advanced infrastructure, seamless customs processes, and efficient logistics systems.

Regional Analysis

1. Top Performers:

Poland: As a regional leader, Poland's LPI score reflects its robust road and rail networks and strong integration with European supply chains. Investments in infrastructure under EU funding mechanisms, like the Connecting Europe Facility (CEF), have further enhanced its competitiveness.

Czech Republic and Hungary: These countries also perform well due to modernised transport networks and strong links to Western European markets.

2. Room for Improvement:

Romania: Despite improvements, Romania still struggles with infrastructure bottlenecks and in efficiencies in customs processes. However, ongoing investments in the Danube river corridor and road infrastructure are expected to enhance its logistics performance.

Croatia: While progress has been made, Croatia’s logistics sector remains constrained by its fragmented geography, which complicates the efficiency of land transport systems.EU-backed port upgrades and road projects aim to address these challenges.

3. Challenges and Opportunities:

Challenges: The CEE region faces shared challenges, including labour shortages in the transport sector, geopolitical tensions from the Russia-Ukraine war, and rising fuel costs.

Opportunities: Continued investments in digitalisation, multimodal transport systems,and green logistics off er opportunities for sustained improvements.

Comparison with Global Leaders

CEE countries lag behind Western Europe in LPI rankings, with the highest-ranked regional performer (Poland) still trailing Germany and the Netherlands. However, the region is rapidly catching up, leveraging EU funding and increasing integration with global supply chains.Investments in smart logistics and sustainable infrastructure could further boost the region’s standing.

The LPI underscores the need for targeted reforms in infrastructure, regulatory frameworks, andcross-border coordination to enhance logistics competitiveness in CEE. With ongoing improvements the region is well-positioned to strengthen its role as a vital logistics hub in Europe.

Are you interested in the full version of the report & more insights into the transportation sector, more data, and analysis from the world's fastest-growing markets?

Request EMIS Demo

ABOUT EMIS INSIGHTS

What sets EMIS reports apart and makes them trustworthy?

EMIS offers a large repository of content to support journalists in reporting on emerging markets from both a country-specific and industry-specific perspective. Our team of researchers and economists analyses the industries and M&A landscape of key emerging markets, providing accurate and detailed intelligence to equip journalists with the necessary knowledge to cover these markets with confidence.

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest-growing markets. We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools. EMIS delivers trustworthy intelligence covering more than 370 industry sectors and 12 million companies across 197 markets – providing everything you need in one place as actionable insights are facilitated by leading technology. EMIS is part of ISI Markets.

EMIS Insights

EMIS’ industry research division, EMIS Insights, provides in-depth, industry research in key emerging markets worldwide, featuring market overviews, industry trend analysis, legislation and profiles of the leading sector companies provided by experienced locally-based industry analysts.

EMIS Insights M&A Reports

EMIS Insights M&A reports provide analytical summary of M&A activity in key emerging regions and countries. Contents include an overview of M&A activity by deal volume and value, activity by sectors, foreign investors, private equity, valuation trends, top M&A deals and IPOs, advisory league tables, and analysis of the latest developments and future expectations.