Report Content

Reaching new heights

Central and Eastern European strategic resilience in insurance: outlook 2025

-

- Foreword & Executive summary

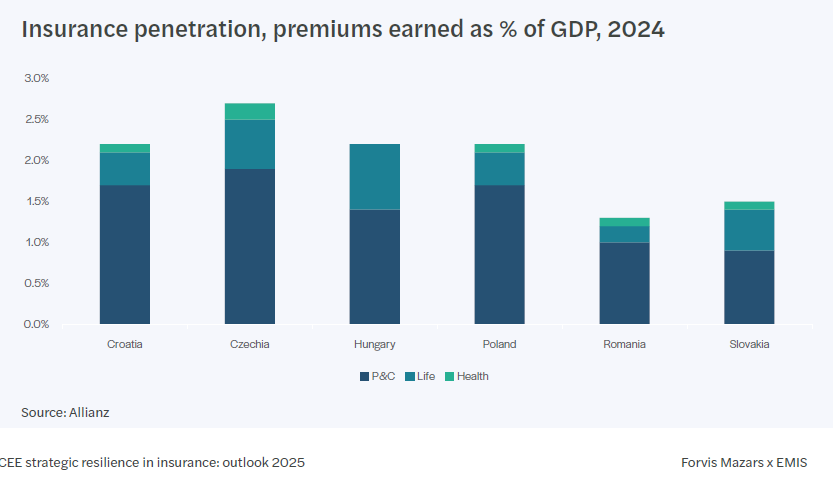

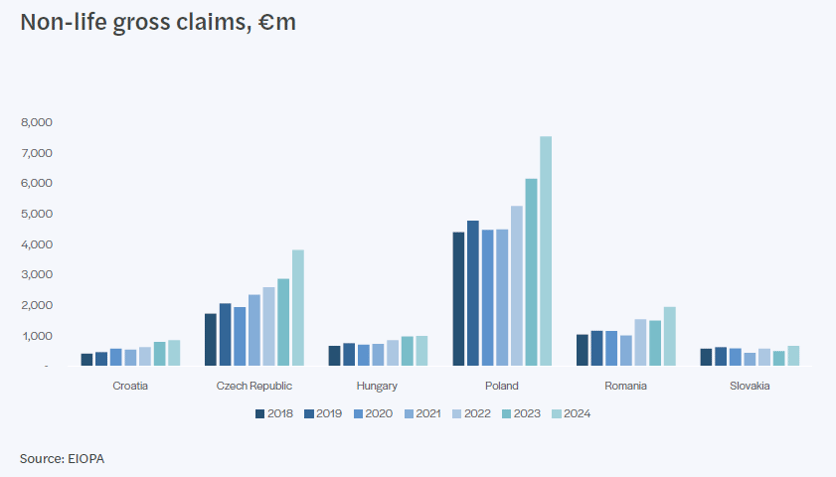

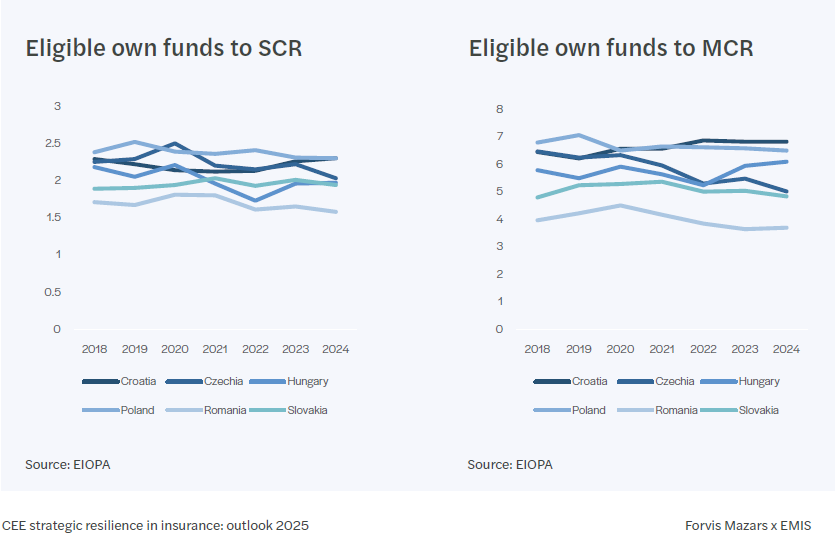

- Premium growth, profitability pressures and capital strength

- Rewiring insurance: AI, cloud and customer-centric innovation

- Navigating AI, innovation, compliance and transformation in CEE

- Compliance in motion: the insurance sector’s response to the EU reform

- Solvency II Directive - what insurers need to know by 2027

- IFRS 17 in practice: stabilisation, divergence and the road ahead

- Stress testing the future: climate risk, regulation and readiness in CEE

![]()

Are you interested in more insights into the CEE Insurance Sector?

Watch Our Expert Panel Session!

What sets EMIS apart?

EMIS is a leading curator of multi-sector, multi-country research for the world’s fastest growing markets.

We provide a unique combination of research from globally renowned information providers, local and niche specialist sources, our own proprietary analysis, and powerful monitoring and productivity tools.

EMIS delivers trustworthy intelligence for over 370 industry sectors and over 17m companies (including +190k M&A and ECM deals) across 197 markets. Everything you need in one place where actionable insights are facilitated by leading technology.

EMIS Insights

EMIS’ industry research division, EMIS Insights, provides in-depth, industry research in key emerging markets worldwide, featuring market overviews, industry trend analysis, legislation and profiles of the leading sector companies provided by experienced locally-based industry analysts.

EMIS Insights M&A Reports

EMIS Insights M&A reports provide analytical summary of M&A activity in key emerging regions and countries. Contents include an overview of M&A activity by deal volume and value, activity by sectors, foreign investors, private equity, valuation trends, top M&A deals and IPOs, advisory league tables, and analysis of the latest developments and future expectations.